NEWS

By Amruta Khandekar and Leroy Leo

(Reuters) – Plunging valuations have made biotech companies tempting acquisition targets for cash-rich Big Pharma and a flurry of deals is just what the battered sector needs to turn a corner.

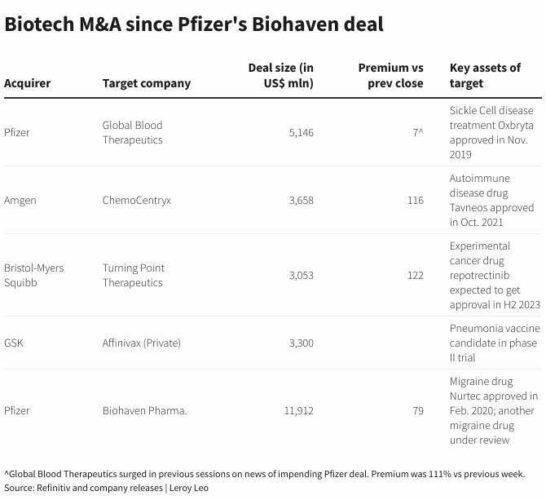

Pfizer’s $5.4 billion acquisition of Global Blood Therapeutics, which was announced on Monday, is the fourth deal in the sector since the pharma giant bought Biohaven for $11.6 billion in May, adding to optimism that large drugmakers are back in the market to pick up cheaper firms.

Industry experts predict biotech firms that are closer to getting their product to market or already have a drug approved are likely to become M&A targets for large drugmakers, some of whom are staring at patent expirations of their cash cow drugs.

GRAPHIC: Biotech M&A since Pfizer’s Biohaven deal (https://fingfx.thomsonreuters.com/gfx/mkt/dwvkrwzwmpm/VA2Zh-m-as-since-pfizer-s-biohaven-deal.png)

(There have been) acquisitions of companies that have late-stage assets and also the theme of large-cap companies keeping an eye on mid-caps approaching blockbusters,” RBC Capital Markets analyst Gregory Renza said. So needing to replenish portfolios and finding companies like those are key.

Biotech company stocks have been battered in the past few months as investors booked profits after a sharp rise in valuations in 2021, with the rout exacerbated by a dearth of large deals and lack of positive data from clinical trials.

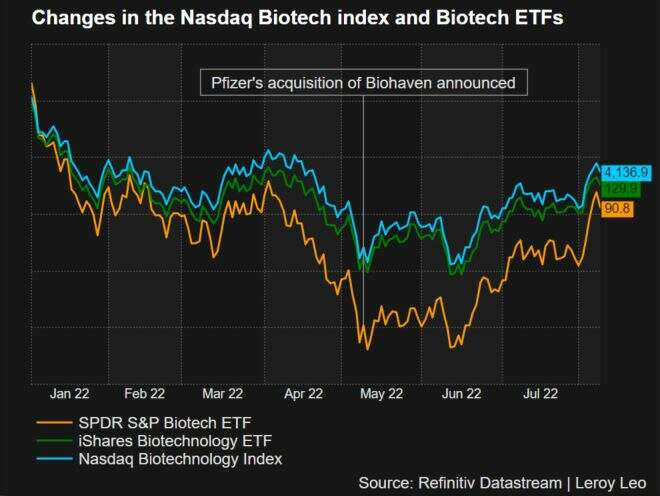

The Nasdaq Biotechnology index fell nearly 28% in the year till the Pfizer-Biohaven deal was announced in May. Since then, the index is up over 18%.

The SPDR S&P Biotech ETF is also up 34% in that period, while iShares Biotechnology ETF is up about 19%.

GRAPHIC: Changes in the Nasdaq Biotech index and biotech ETFs (https://fingfx.thomsonreuters.com/gfx/mkt/zdvxozxyxpx/SnP%20Biotech%20ETF%20NBI%20index.JPG)

Pfizer’s move put boards across big pharma on notice that if you’re not in the market buying these companies while they’re cheap, your competitors will,” Thomas Hayes, chairman and managing member of Great Hill Capital in New York, said.

Still, not all analysts are convinced the bottom has been reached for these stocks and believe there is still a long way to go for biotechs, especially considering the risky nature of the business.

“I don’t think we’ll get back to 2021 (funding) levels … but we’re seeing a nice virtuous cycle of good data, more capital entering the space and more M&A,” Sean Sun, portfolio manager at Thornburg Investment Management, said.

Sentiment around the beaten-down sector has improved in the past month.

About $86 million was poured into iShares Biotechnology ETF in July, compared with $7 million in June, following outflows in the two preceding months, according to Refinitiv Lipper data.

The number of stocks in the biotech index that trade below their cash level has also reduced. One of four biotech stocks that are part of the index now trade below their cash level, from one of three in the last week of June, Refinitiv data showed.

The fundamentals are strong as ever, the valuations have corrected and the acquirers have a boatload of money,” said Lee Brown, global healthcare leader for investment research firm Third Bridge. “So it’s sort of like – let’s party.”

(Additional reporting by Medha Singh; Editing by Ankur Banerjee and Shounak Dasgupta)