NEWS

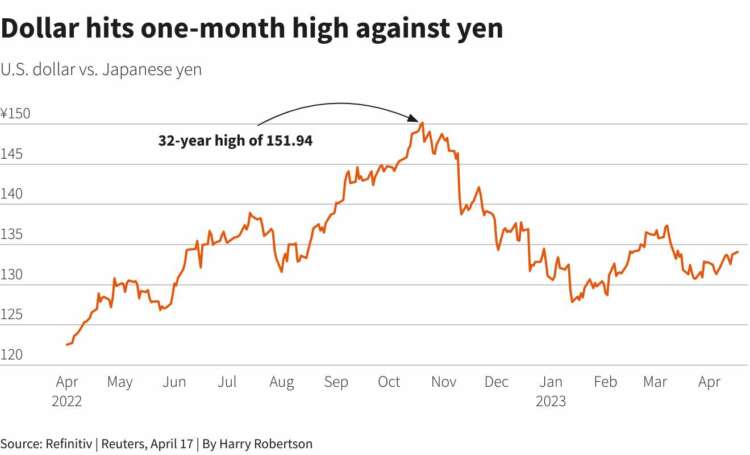

Dollar hits one-month high against yen as traders bet on Fed rate hike

By Harry Robertson

LONDON (Reuters) – The dollar climbed to a one-month high against Japan’s yen on Monday as traders eyed up another interest rate hike from the Federal Reserve, while the Bank of Japan stuck to its easy-money policies for now.

The dollar rose to 134.22 yen earlier in the session, the highest level since March 15. It was last up 0.19% at 134 yen.

Meanwhile, the dollar index – which measures the currency against six major peers – was little changed at 101.66. It touched a one-year low of 100.78 on Friday before rebounding somewhat.

The dollar has bounced back but also we’ve had comments from the Bank of Japan indicating that there is no real reason for them to pull back from their ultra easy policy,” said Jane Foley, head of FX strategy at Rabobank.

Expectations that interest rates will rise relative to global peers tend to boost a country’s currency by making investments there look more attractive, and vice versa.

New Bank of Japan Governor Kazuo Ueda last week made clear that the country would remain a “dovish” outlier by keeping interest rates at ultra-low levels for the time being.

(Graphic: Dollar hits one-month high against yen – https://www.reuters.com/graphics/GLOBAL-FOREX/jnpwylzabpw/chart.png)

Meanwhile, pricing in derivatives markets shows traders think there’s a roughly 86% chance the Fed will hike rates again by 25 basis points in May, up from around 69% last week.

That increase came after past U.S. retail sales figures were revised upwards, a Fed official said rate hikes were yet to have the desired effect, and consumer inflation expectations rose on Friday.

The euro was roughly flat against the dollar on Monday at $1.098.

It hit a one-year high of $1.108 on Friday, with traders expecting further interest rate hikes from the European Central Bank even as the Fed nears a pause.

Sterling slipped 0.07% to $1.241, after hitting a 10-month high of $1.255 on Friday.

Beat Nussbaumer, a currency trader and portfolio manager, said he thought the market was set for a dull patch, bar any major crisis.

I think the dollar will weaken over the next many, many weeks, but the story is so marginal that it will be a slow burner,” he said.

“There’s a bit of a vacuum out there right now. It’s going to be data to data.”

Rabobank’s Foley said investors would monitor comments from the Fed, with Austan Goolsbee, Christopher Waller, and Loretta Mester among the U.S. officials due to speak this week.

Foley expects one more 25 basis point rate hike from the Fed in May before it holds rates steady for the rest of the year.

Investors will also keep an eye on bank earnings, with Bank of America and Goldman Sachs due to report on Tuesday.

(Reporting by Harry Robertson; Editing by Muralikumar Anantharaman and Mark Potter)