FINANCE

By Anshuman Daga

(Reuters) – Credit Suisse said on Thursday it would borrow up to $54 billion from the Swiss central bank to shore up liquidity after a slump in its shares and bonds intensified fears about a global banking crisis. Analysts said they think that might not be enough.

WHAT EVENTS LED TO THE RECENT SHARE SLUMP?

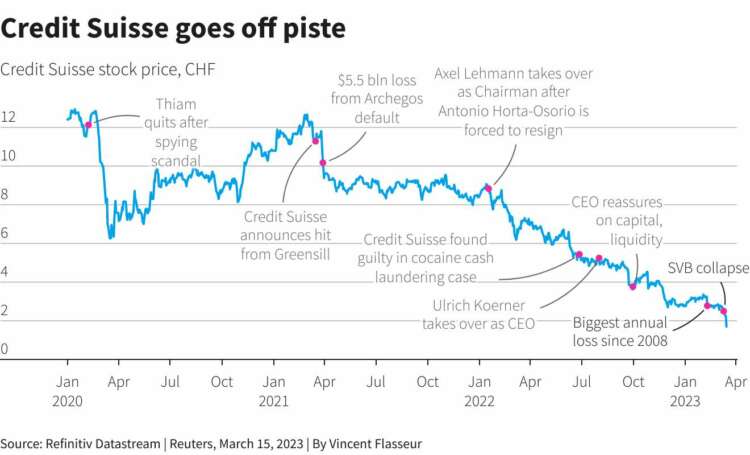

A string of scandals over many years, top management changes, multi-billion dollar losses and an uninspiring strategy can be blamed for the mess that the 167-year-old Swiss lender now finds itself in.

The sell-off in Credit Suisse’s shares began in 2021, triggered by losses associated with the collapse of investment fund Archegos and Greensill Capital.

In January 2022, Antonio Horta-Osorio resigned as chairman for breaching COVID-19 rules, just eight months after he was hired to fix the ailing bank.

In July, new CEO and restructuring expert Ulrich Koerner unveiled a strategic review – but failed to win over investors.

An unsubstantiated rumour on an impending failure of the bank in the autumn sent customers fleeing.

Credit Suisse confirmed last month that clients had pulled 110 billion Swiss francs of funds in the fourth quarter while the bank suffered its biggest annual loss of 7.29 billion Swiss francs since the financial crisis. In December, Credit Suisse had tapped investors for 4 billion Swiss francs.

On Wednesday, Saudi National Bank, the bank’s top backer, told reporters it could not give more money to the bank as it was constrained by regulatory hurdles, while saying it was happy with the bank’s turnaround plan.

The shares have lost 75% over the past one year.

(Graphic: Credit Suisse and its problems – https://www.reuters.com/graphics/CREDITSUISSEGP-STOCKS/akveqegdgvr/chart.png)

WHAT STEPS CAN CREDIT SUISSE TAKE TO CALM INVESTORS?

Credit Suisse has said it would borrow up to $54 billion to shore up liquidity and investor confidence but some analysts believe that is unlikely to be enough to soothe investors.

Winning the backing of strategic investors could be one option to shore up market confidence. It counts Qatar Investment Authority and Saudi conglomerate Oyalan Group among its investors.

In the early days of the global financial crisis in 2008, UBS took on Singapore sovereign wealth fund GIC as an investor but the stake sell-down ultimately resulted in a loss for GIC.

Divesting stakes in various assets is an option as Credit Suisse owns an asset management business and a stake in SIX Group, which runs the Zurich stock exchange.

Credit Suisse has pivoted to a strategy to cater to rich clients while cutting back on its volatile investment banking business and has already announced plans to spin it off.

HOW IMPORTANT IS CREDIT SUISSE?

The bank ranks among the world’s largest wealth managers and crucially it is one of 30 global systemically important banks, whose failure would cause ripples through the entire financial system.

Credit Suisse has a local Swiss bank, wealth management, investment banking and asset management operations. It has just over 50,000 employees and 1.6 trillion Swiss francs in assets under management at the end of 2021.

With more than 150 offices in around 50 countries, Credit Suisse is the private bank for a large number of entrepreneurs, rich and ultra rich individuals and companies.

(Reporting by Anshuman Daga and Swiss bureau; Editing by Sumeet Chatterjee, Elisa Martinuzzi and Elaine Hardcastle)

-

-

BUSINESS4 days ago

Building a Diverse and Inclusive Team in Your Startup

-

-

-

FINANCE4 days ago

Changelly launches Probably Serious Quiz introducing 0% fee swaps of USDt on TON and Toncoin

-

-

-

BUSINESS3 days ago

Essential Strategies for Startup Bootstrapping and Financial Management

-

-

-

NEWS4 days ago

Global equity market-neutral hedge funds shine

-