NEWS

(Reuters) – Global equity funds remained out of favour in the seven days to Sept. 7 as a strong U.S. services industry report fuelled concerns that the Federal Reserve would keep hiking interest rates to tame inflation.

Some investors had expected that the Fed might temper its rate hikes to avert a slowdown in the economy, which in turn would boost risk assets.

Another bearish factor for equities was a deepening of Europe’s energy crisis after Russia said one of its main gas supply pipelines to the West would stay shut indefinitely, stoking renewed fears about shortages.

Investors dumped global equity funds worth a net $23.99 billion after ditching $31.73 billion worth of funds in the previous week, data from Refinitiv Lipper showed.

GRAPHIC: Fund flows: Global equities bonds and money market https://fingfx.thomsonreuters.com/gfx/mkt/zjvqkrnazvx/Fund%20flows-%20Global%20equities%20bonds%20and%20money%20market.jpg

U.S. and European equities funds recorded outflows worth a net $14.83 billion and $10.14 billion respectively, while Asia posted inflows of $1.23 billion.

Alejandra Grindal, chief economist at Ned Davis Research, said high inflation and tighter monetary policy were having an impact on global equities, adding that the energy crisis presents a much greater near-term risk for the euro zone.

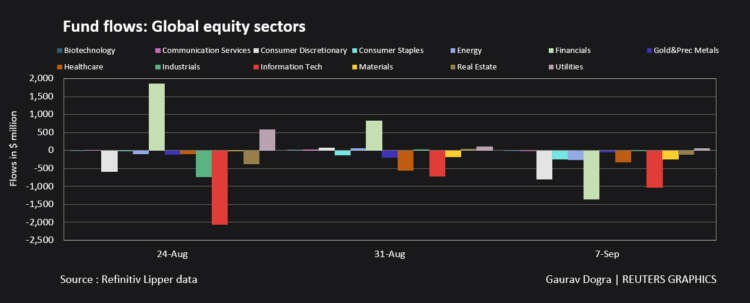

Financials and consumer discretionary funds witnessed net selling of $1.36 billion and $810 million respectively, after both seeing inflows in the week before. Tech also faced withdrawals worth $1.03 billion in a third week of selling.

GRAPHIC: Fund flows: Global equity sector funds https://fingfx.thomsonreuters.com/gfx/mkt/xmvjoabjmpr/Fund%20flows-%20Global%20equity%20sector%20funds.jpg

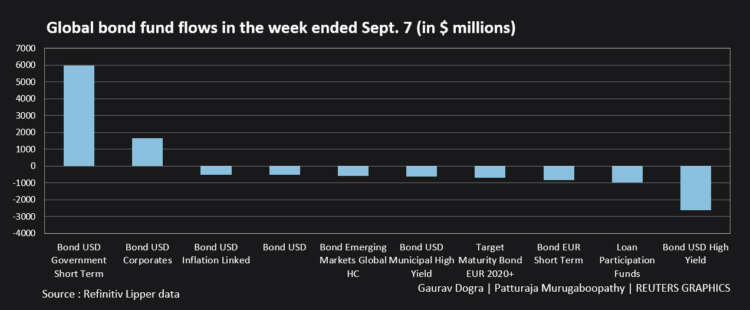

Bond funds also remained out of favour for the third week in a row as they suffered net selling of $2.51 billion, although outflows reduced by 70% from the previous week.

Investors trimmed positions in high yield and, short and medium-term bond funds by $4.03 billion and $947 million respectively, but weekly purchases of government bond funds jumped to a eight week high of $5.43 billion.

GRAPHIC: Global bond fund flows in the week ended Sept. 7 https://fingfx.thomsonreuters.com/gfx/mkt/gkvlgnbjrpb/Global%20bond%20fund%20flows%20in%20the%20week%20ended%20Sept%207.jpg

Meanwhile, money market funds saw $934 million worth of inflows after witnessing outflows for four consecutive weeks.

Energy funds received $138 million in their first weekly inflow in four weeks, but selling in precious metal funds continued for an 11th week, totalling $455 million.

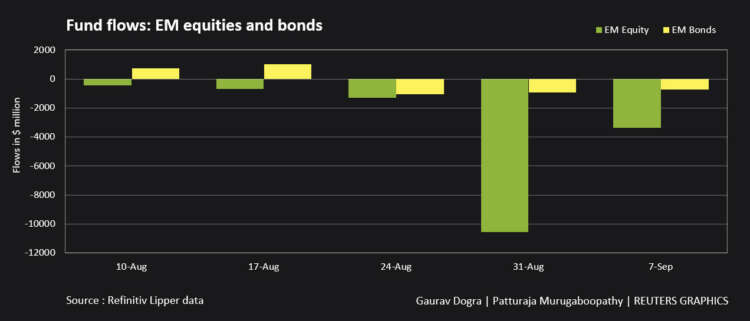

An analysis of 24,506 emerging market funds showed both equity and bonds suffered a third weekly outflow, amounting to $3.37 billion and $738 million respectively.

GRAPHIC: Fund flows: EM equities and bonds https://fingfx.thomsonreuters.com/gfx/mkt/myvmnzbjzpr/Fund%20flows-%20EM%20equities%20and%20bonds.jpg

(Reporting by Gaurav Dogra and Patturaja Murugaboopathy in Bengaluru; Editing by Alexander Smith)

-

-

BUSINESS3 days ago

Building a Diverse and Inclusive Team in Your Startup

-

-

-

FINANCE4 days ago

Navigating the Maze: A Beginner’s Guide to Home Loans

-

-

-

BUSINESS4 days ago

Strategies for Attracting and Retaining Talent in Startups

-

-

-

FINANCE3 days ago

Changelly launches Probably Serious Quiz introducing 0% fee swaps of USDt on TON and Toncoin

-